The Smarter Way

TWO PHOTOS

ZERO GPS

IRS-compliant mileage tracking. Zero battery drain. Just snap and go.

.png)

The Smarter Way

IRS-compliant mileage tracking. Zero battery drain. Just snap and go.

.png)

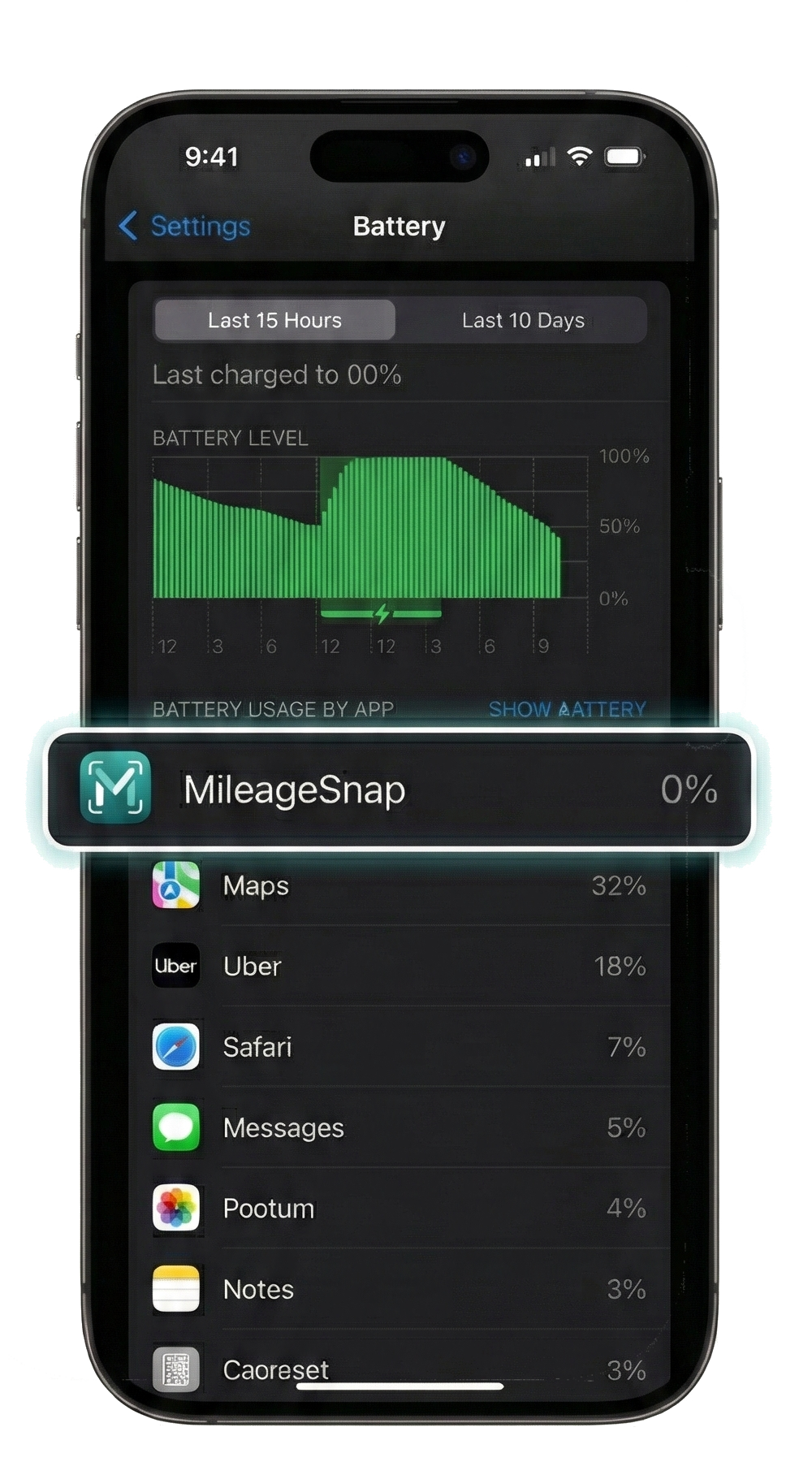

Better battery life. Better privacy. Better proof for the IRS.

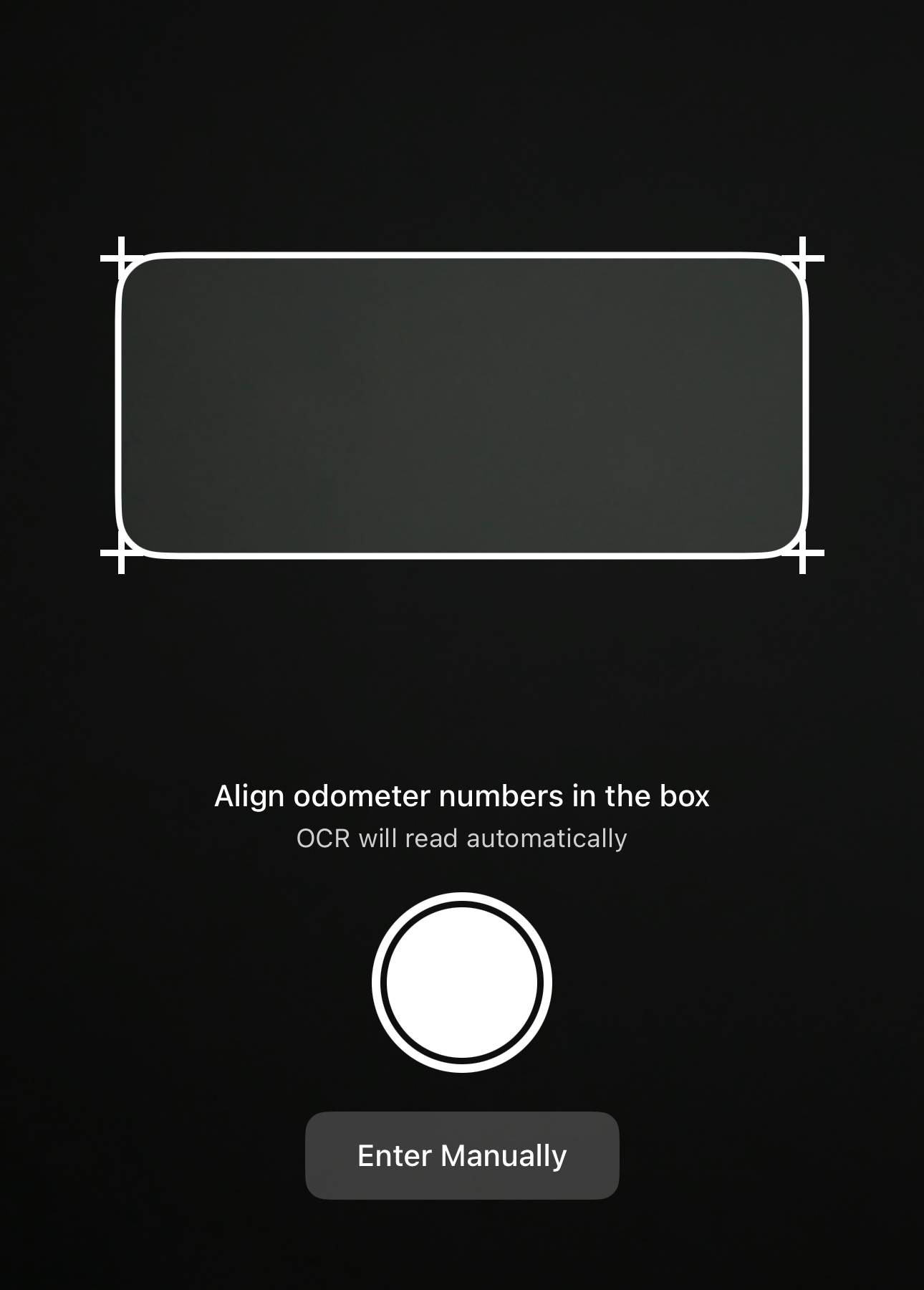

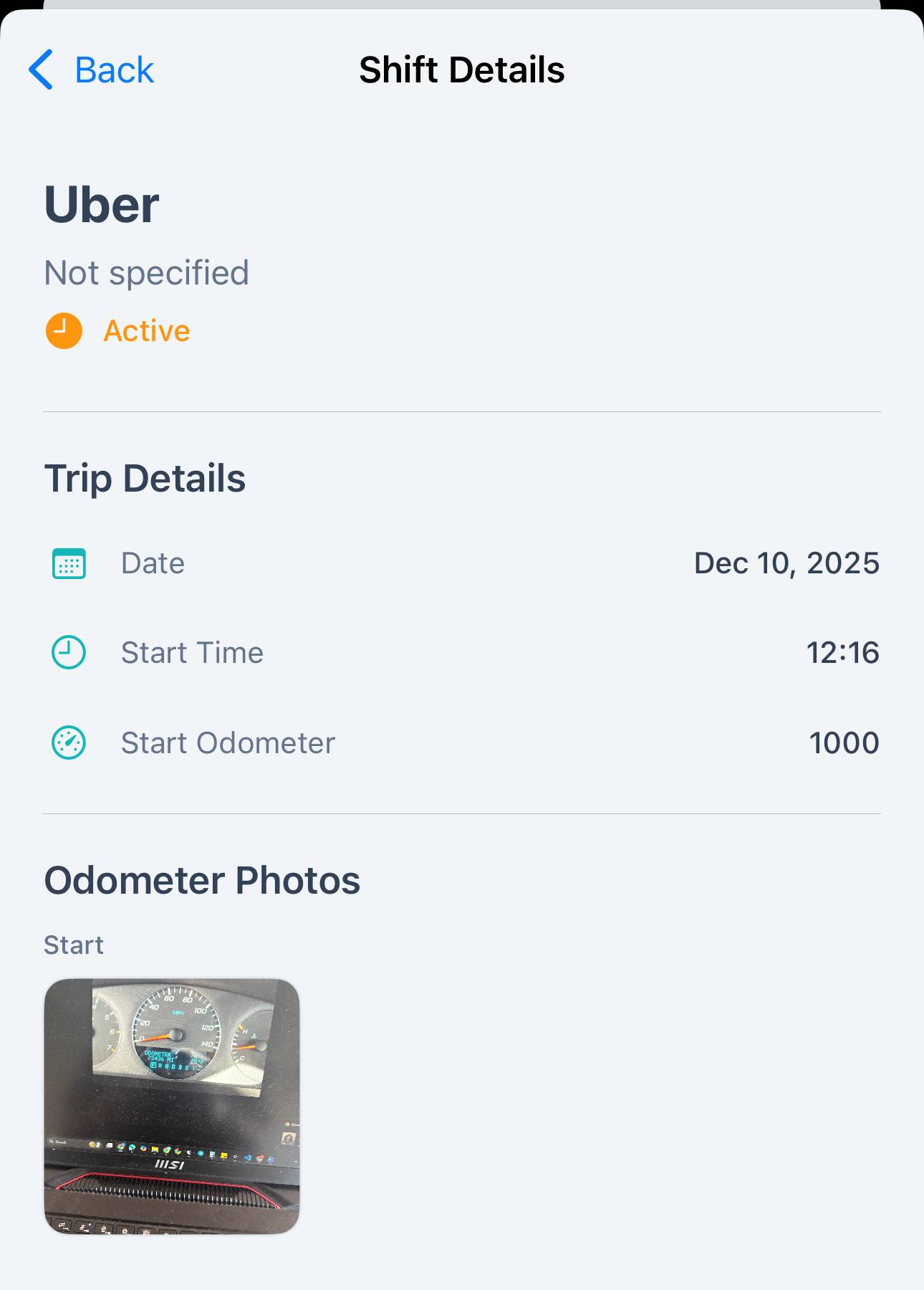

When you start working, open MileageSnaps and take a quick photo of your odometer. That's it. The app uses OCR to automatically read the numbers - you don't type anything.

No app running in the background. No GPS draining your battery. No constant location tracking. Just drive and work like normal. Your phone stays in your pocket.

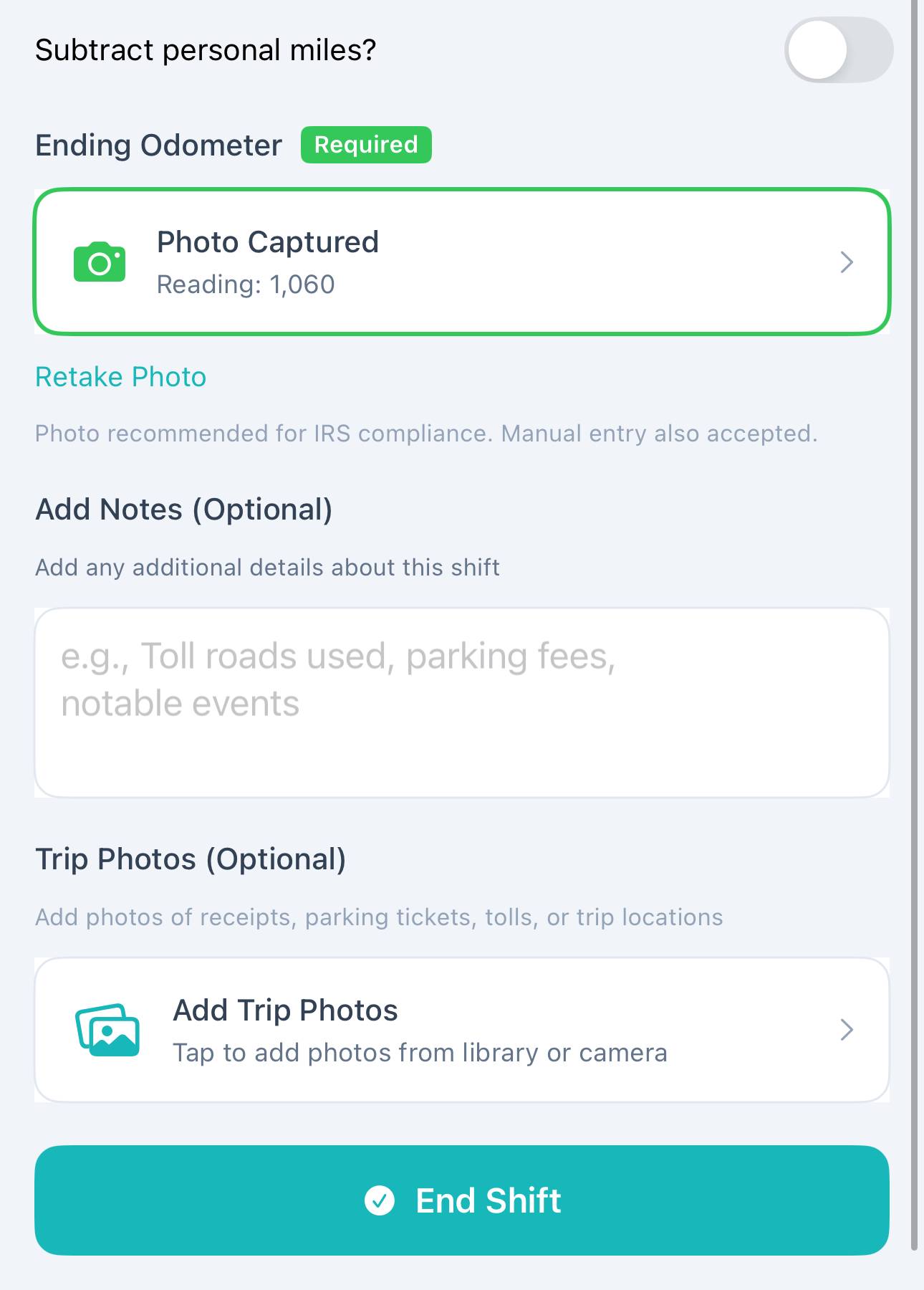

When you're done working, take another photo. MileageSnaps calculates your miles instantly and shows your deduction. Tag it (Uber, Lyft, DoorDash, Client, etc.) and save.

"Finally, a mileage tracker that doesn't kill my battery! I was losing 30% battery daily with my old GPS tracker. With MileageSnaps, I just snap 2 photos per shift and I'm done. Game changer for Uber drivers."

"Saved me $3,200 on my taxes last year! My accountant loved how organized my records were. The photo proof makes audits stress-free. Worth every penny."

"Privacy matters to me. I hated that my old app tracked everywhere I went, even personal trips. MileageSnaps only tracks work miles with photos - no creepy GPS surveillance."

"So much easier than Everlance. No sorting through personal drives, no manual classifications. Just 2 photos = done. Saves me 15 minutes every day."

"The OCR is scary accurate. It reads my odometer perfectly every time. And having photo proof for every shift? That's audit-proof documentation right there."

"Switched from MileIQ and never looking back. Half the price, better privacy, and my battery actually lasts the full day now. This is how mileage tracking should work."

Snap your odometer and the app automatically reads the numbers. No typing, no mistakes, no hassle.

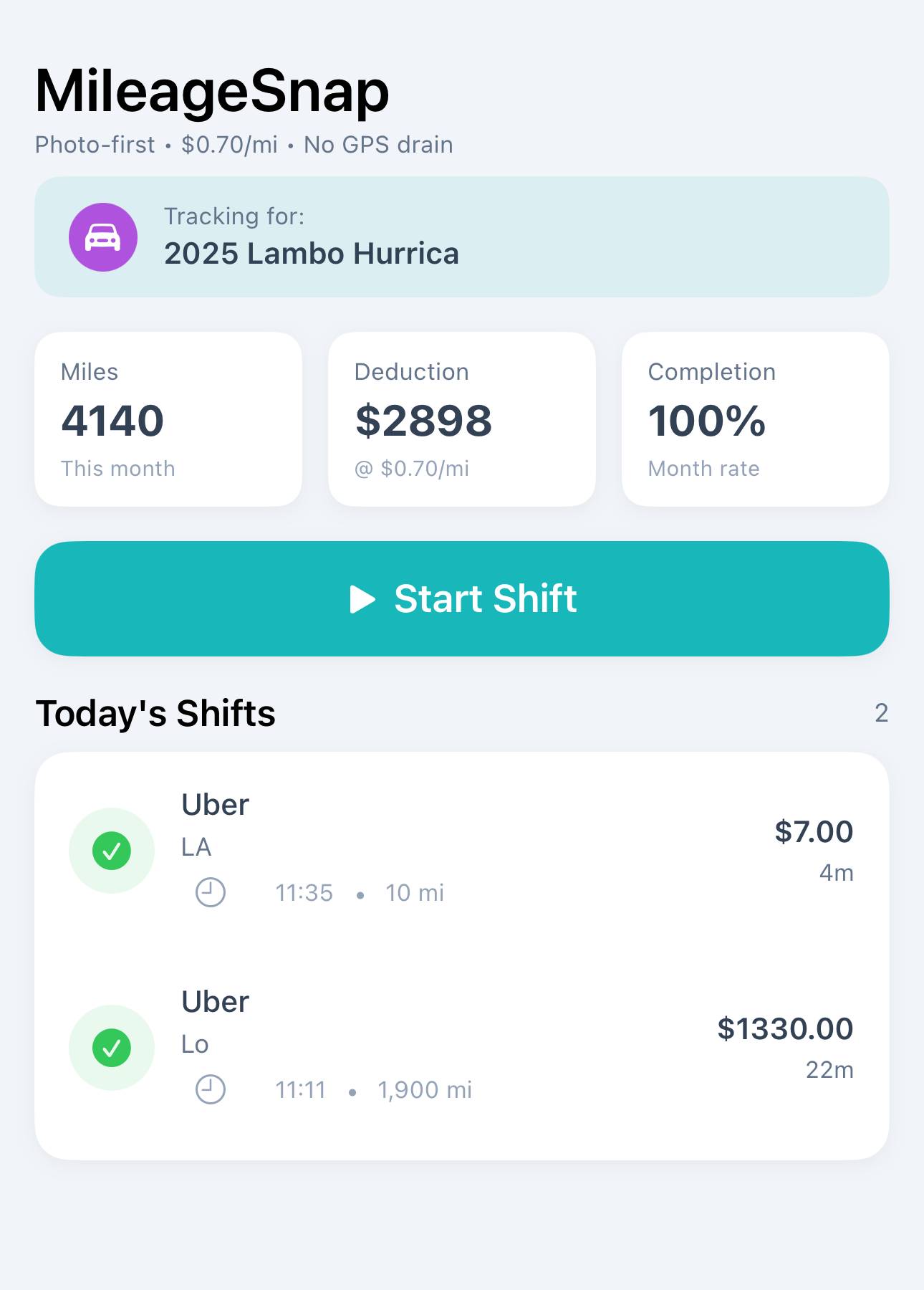

Track work time, not your whole life. Start when you clock in, end when you clock out. That simple.

Export to CSV or PDF with all required documentation. Your accountant will thank you.

Tag each shift: Uber, Lyft, DoorDash, Client Meeting, Delivery. Know exactly where your miles come from.

Optional Bluetooth nudges when you park remind you to end your shift. Never forget to log miles again.

No GPS tracking. No route recording. We don't know where you go. Your location stays private.

When you start working (Uber, deliveries, client visits), open the app and tap Start Shift.

Take a photo of your odometer. OCR reads the numbers automatically - no typing required.

Drive, work, earn. The app stays quiet - no battery drain, no tracking, no notifications.

When done, snap another photo. Tag the purpose (Uber/Lyft/Client). See your deduction instantly.

See how MileageSnaps compares to traditional GPS mileage apps

$29.99/year

$60-100/year

Uber and Lyft drivers love our photo verification for maximum tax deductions

Freelancers and contractors get audit-proof records with minimal effort

Business owners track employee mileage with complete accountability

DoorDash, Instacart, and delivery drivers maximize their reimbursements

Track client visits and property showings with photo-verified miles

Plumbers, electricians, and contractors track job site trips effortlessly

Yes! MileageSnaps captures all required IRS fields: date, starting/ending odometer, business purpose, and destination. Photo proof provides even stronger audit defense than GPS logs.

Our OCR reads odometer numbers with 99%+ accuracy using Apple Vision technology. If it misses, you can manually correct it in seconds.

Absolutely! Tag each shift with a vehicle name. Perfect for drivers who switch between cars or manage a small fleet.

You can manually enter past shifts with your odometer readings and the date. Your photos are your proof.

Join thousands of drivers who've switched to stress-free mileage tracking.

Free to download • Available for iPhone • No subscriptions required